Share this

September 2025 Market Quick Hit

Dec 01, 2025

Market Roundup

-

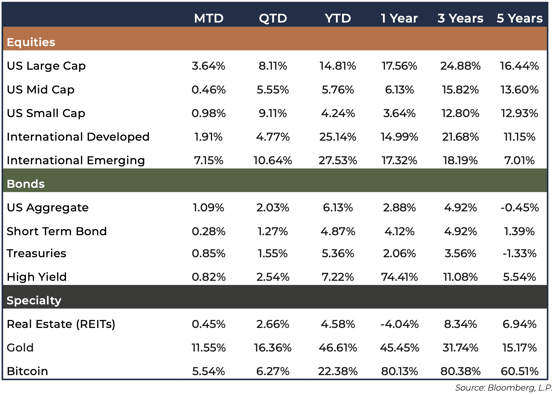

Global stocks rose in September as investors focused on resilient corporate earnings despite mixed economic news.

-

Treasury yields dipped slightly in September alongside the much-anticipated Fed rate cut leading to modestly positive returns for bonds.

-

Primary economic indicators such as GDP showed stronger than anticipated economic growth while core inflation and jobs data offered a negative trending sentiment.

-

The US Dollar continued to weaken in September with the Fed cut rate, high US debt levels, and a looming government shutdown contributing to the softness.

- Gold continued its rise as investors view it as a safe-haven asset and a hedge against a weakening US dollar and inflation.

Positioning & Outlook

-

For the rest of 2025, investors face a tug-of-war between resilient corporate earnings and mixed economic data and policy uncertainty.

-

Equity strength could be challenged by elevated valuations with any earnings disappointments potentially leading to increased volatility.

-

The Fed faces a challenge with mixed messages coming from economic data and with heightened political pressure to continue with rate cuts.

-

We see a strong likelihood of at least one more cut through the end of 2025, but remain uncertain on its impact on the longer-term end of the curve and therefore recommend staying shorter duration in fixed income portfolios.

- With mixed economic data, we continue to favor diversification across public and private market opportunities.

Disclosures

Important Information

Advisory services are provided by Bison Wealth, LLC (“Bison”) an investment adviser registered with the SEC. Registration does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is believed to be reliable, has not been independently verified and is based on the opinions of Bison and subject to change at any time without notice. Nothing herein should be deemed an offer or solicitation to buy or sell a security or to provide investment advice. All investments contain risks to include the total loss of invested amounts. Past performance is not indicative of future results. Diversification does not protect against losses.

Index Disclosure

An index typically measures the performance of a basket of securities intended to replicate a certain area of the market, asset class or geopolitical region among others. Indices do not represent investments in actual accounts. Investors cannot invest directly in an index. The asset classes noted here reflect the following indices: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

Share this

- March 2026 (1)

- February 2026 (1)

- January 2026 (1)

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)