Share this

November 2025 Market Quick Hit

Dec 01, 2025

Market Roundup

-

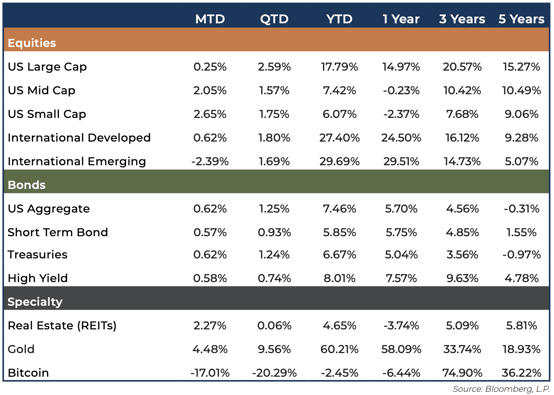

Major US equity indices pushed higher in November after staging a comeback from a mid-month spike in volatility.

-

Bond yields fell during the month as expectations increased for another quarter point interest rate cut from the Federal Reserve.

-

Small and mid-cap stocks also benefited from falling yields, helping them outperform large caps for the first time since August.

-

Despite no official data on jobs or inflation due to the government shutdown, inflation appears elevated to target yet relatively moderate, while the job market continued to cool as hiring slows.

- Corporate earnings remain strong with Q3 on pace to deliver the highest revenue growth rate for companies in the S&P 500 Index in 3 years.

Positioning & Outlook

-

The environment remains accommodative for equities, supported by moderate inflation and increased likelihood of lower interest rates from the Federal Reserve.

-

While valuations may appear extended, particularly in firms associated with AI, higher earnings growth suggests justification for the high values and lowers fears of a “bubble” being created.

-

Going forward, returns may become more selective as investors navigate between elevated valuations and earnings growth.

-

Ongoing geopolitical tensions and US policy uncertainty may lead to episodic spikes in market volatility.

- \Broad diversification beyond traditional stocks and bonds – such as private market opportunities – may help protect portfolios against market risks while still offering attractive return potential.

Disclosures

Important Information

Advisory services are provided by Bison Wealth, LLC (“Bison”) an investment adviser registered with the SEC. Registration does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is believed to be reliable, has not been independently verified and is based on the opinions of Bison and subject to change at any time without notice. Nothing herein should be deemed an offer or solicitation to buy or sell a security or to provide investment advice. All investments contain risks to include the total loss of invested amounts. Past performance is not indicative of future results. Diversification does not protect against losses.

Index Disclosure

An index typically measures the performance of a basket of securities intended to replicate a certain area of the market, asset class or geopolitical region among others. Indices do not represent investments in actual accounts. Investors cannot invest directly in an index. The asset classes noted here reflect the following indices: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

Share this

- March 2026 (1)

- February 2026 (1)

- January 2026 (1)

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)