Share this

June 2025 Market Quick Hit

Jul 01, 2025

Market Roundup

-

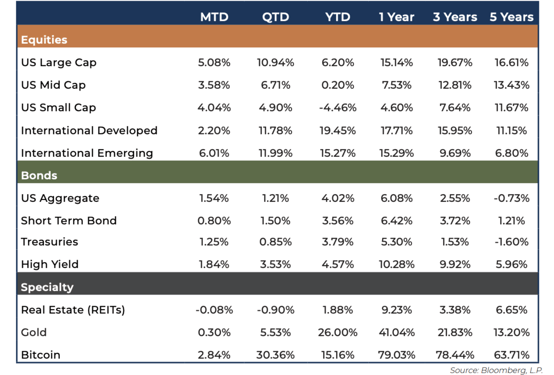

After an initial drop to start the quarter on the heels of tariff announcements, the stock market rebounded with the S&P 500 up 5.1% in June and nearly 11% for the quarter, finishing at an all-time high on the last day of the month.

-

Gains were driven by strong corporate earnings, strength in the technology and communications sectors, and optimism for potential Fed rate cuts.

-

Treasury yields fell during June, with the 10-year treasury yield falling to 4.24%, boosting bond returns during the month.

-

Longer-term bonds benefited the most from the falling rates as well as increased expectations for a Fed rate cut, while shorter-term bonds saw pressure from Treasury supply concerns.

Positioning & Outlook

-

The Fed held interest rates steady at their June meeting, trimming their GDP forecast from 1.7% to 1.4% for the year and raising their PCE inflation forecast to 3.0% and projecting unemployment rise to 4.5%.

-

Slowing GDP and labor metrics support the case for eventual rate cuts from the Fed, but inflation persists higher than desired levels, which may temper Fed action.

-

We continue to be on heightened awareness for short-term volatility stemming from unresolved tariff negotiations and geopolitical tensions that persist in both Ukraine and the Middle East.

-

Our recommended portfolios continue to favor diversification across regions as well as in strategies that demonstrate low correlation with public stock and bond markets to help dampen a potential wave of short-term volatility.

Disclosures

Important Information

Advisory services are provided by Bison Wealth, LLC (“Bison”) an investment adviser registered with the SEC. Registration does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is believed to be reliable, has not been independently verified and is based on the opinions of Bison and subject to change at any time without notice. Nothing herein should be deemed an offer or solicitation to buy or sell a security or to provide investment advice. All investments contain risks to include the total loss of invested amounts. Past performance is not indicative of future results. Diversification does not protect against losses.

Index Disclosure

An index typically measures the performance of a basket of securities intended to replicate a certain area of the market, asset class or geopolitical region among others. Indices do not represent investments in actual accounts. Investors cannot invest directly in an index. The asset classes noted here reflect the following indices: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

Share this

- February 2026 (1)

- January 2026 (1)

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)