Share this

July 2025 Market Quick Hit

Aug 01, 2025

Market Roundup

-

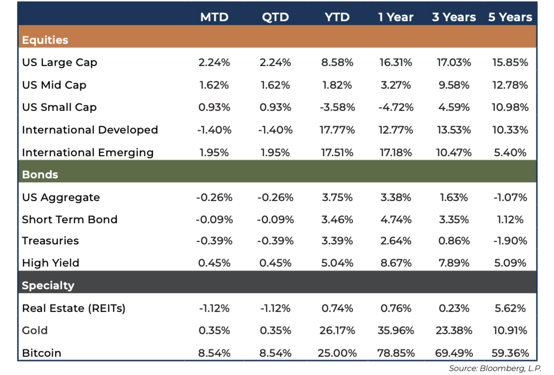

US equity markets extended gains for the 3rd consecutive month with mega-cap technology stocks once again leading the way.

-

With nearly 60% of companies reporting Q2 earnings by month end, over 78% have beaten earnings estimates, reinforcing investor confidence.

-

Small cap stocks underperformed due to weaker margins and interest rate sensitivity.

-

Yield on the 10-year treasury rose to 4.41%, backed by stronger than expected economic data and sticky inflation readings, pushing bond prices lower for the month.

- The Fed left rates unchanged, and expectations have been scaled back for a September rate cut.

Positioning & Outlook

-

While the Fed is likely to begin easing in late 2025, we expect rate cuts to be gradual as the Fed balances their data driven approach with increased political pressure.

-

We continue to believe in the broadening participation outside of mega-cap technology stocks with cyclical sectors and small and mid-cap stocks well positioned should economic momentum persist, and interest rates stabilize.

-

The impact of tariffs continues to be a wildcard both in terms of implementation and their ultimate impact on the US economy.

-

Fixed income markets should benefit from eventual rate cuts, particularly at the short end of the yield curve, but upward pressure on yields may persist given higher for longer inflation and increased issuance of treasuries required to fund the recently passed budget.

Disclosures

Important Information

Advisory services are provided by Bison Wealth, LLC (“Bison”) an investment adviser registered with the SEC. Registration does not imply a certain level of skill or training. The information contained herein is for informational purposes only, is believed to be reliable, has not been independently verified and is based on the opinions of Bison and subject to change at any time without notice. Nothing herein should be deemed an offer or solicitation to buy or sell a security or to provide investment advice. All investments contain risks to include the total loss of invested amounts. Past performance is not indicative of future results. Diversification does not protect against losses.

Index Disclosure

An index typically measures the performance of a basket of securities intended to replicate a certain area of the market, asset class or geopolitical region among others. Indices do not represent investments in actual accounts. Investors cannot invest directly in an index. The asset classes noted here reflect the following indices: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

Share this

- February 2026 (1)

- January 2026 (1)

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)