Share this

October 2023 Commentary

Nov 07, 2023

October Market Recap

Key Observations and Outlook

- Stocks fell for the 3rd consecutive month after a strong start to the year. Since the end of July, US Large Caps and Small Caps were down approximately 8% and 17%, respectively.

- Longer-term interest rates (10 yr to 30 yr) continued their upward trajectory, since early July, fueled by stronger than expected economic growth and re-accelerating inflation.

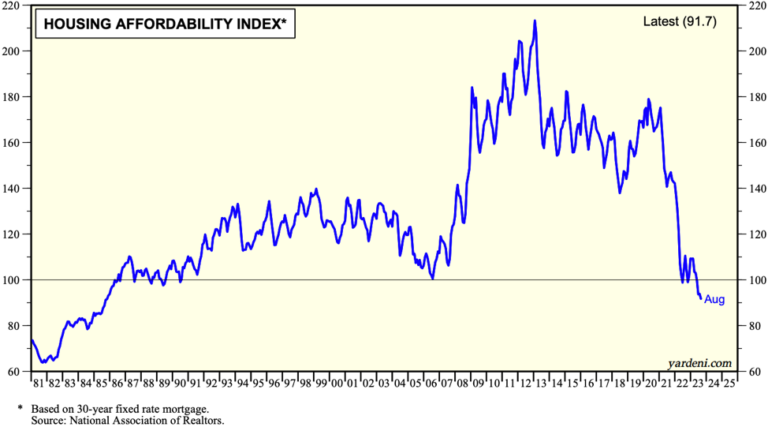

- Mortgage Rates rise above 8% to levels not seen over the past 20 years, taking home affordability to its lowest level in 40 years.

- Reported GDP accelerated in the third quarter to 2.9% year-over-year growth, as consumer and government spending keep economic growth intact.

- The FED is likely to remain on pause, leaving rates unchanged, even with the recent re-acceleration of inflation and economic growth.

Market Commentary

The month of October ended on a down note, completing the 3rd consecutive down month for stocks, following the rally into the end of July. Stocks struggled across the board in October, whether it be large cap, small cap, or international. Since the end of July, US Large Caps and Small Caps were down approximately 8% and 17%, respectively. By the end of the month, investor sentiment had reached bearish extremes and the market reflected a significant oversold condition. Investors looking for a silver lining can point to the excessive bearishness along with the traditional November to December seasonal strength as a reason to be more optimistic through the end of the year. As per below, bearishness just reached its highest level since December of 2022.

Source: Bloomberg, L.P.

Source: American Association of Individual Investors

Long-Term Interest Rates Rise, Negatively Impacting Bond Returns

The 10-year Treasury yield continued its massive surge rising by more than a full percentage point from 3.86% to 4.93% since mid-year, reflecting stronger than expected 3rd quarter economic growth and re-accelerating inflation trends. Stronger growth came from a combination of strong consumer spending trends, combined with plenty of government fiscal stimulus from the Inflation Reduction Act. This is in stark contrast to the ISM manufacturing data reflecting economic contraction in that segment

Following the FED meeting in early September, rates ramped higher as the FED maintained, yet again, its posture of higher rates for longer. Given the stronger economic and inflation numbers, the financial markets were forced to dial back expectations for potential rate cuts, until later into 2024. Ultimately, the 10-year yield reached the 5% level for the first time since 2007. The 16-year high in bond yields grabbed investors’ attention as bond prices fell, with the US Aggregate intermediate bond index posting a negative total return of -1.6% for the month. Short-term bonds fared a bit better, with flat returns for the month, as shorter-term interest rates have remained relatively steady since mid-year, suggesting that the FED may likely be finished with its rate hiking cycle.

Mortgage Interest Rates Reach 24-year High

The Mortgage Bankers Association of America reported that the average contract interest rate for 30-year mortgages reached a record of 7.90% in October, while others have reported rates of 8% or higher. Mortgage rates have increased over 1% in just the past 4 months and have now reached levels not seen since the year 2000. This increase in mortgage rates, combined with housing values that have risen significantly over the past 10 years, has negatively impacted home affordability, taking home affordability as measured by the National Association of Realtors to levels not seen in over 40 years.

This issue creates an interesting dynamic where there is limited inventory of existing single-family homes, as current homeowners choose not to move because they are locked into mortgages at much lower rates, mostly between 3% to 4%. This lack of inventory actually keeps a floor underneath current home prices, perpetuating the affordability issue until mortgage rates come down and/or new housing supply comes to market.

US Economy Accelerates in the 3rd Quarter

Reported Gross Domestic Product (GDP), the benchmark for US economic activity, accelerated in the third quarter to 2.9% year-over-year growth, as consumer and government spending both contributed to strong growth. While the Fed continued raising rates and restricting monetary policy, the government’s contribution to U.S. GDP has increased in 2023 as the federal deficit has widened. This increase in government spending, along with resilient consumer spending, helped to sustain positive economic growth and prevent a recession thus far. With the debt ceiling deal in place and a deadline to reach an agreement on a budget by the end of 2023, it is unlikely that government spending will increase at the same pace in future quarters. If Congress cannot reach a budget deal by the end of the year, then spending caps will be changed to reflect a 1% cut to discretionary spending from FY 2023 levels. Such a moderation in the growth of government spending could act as a headwind to economic growth in 2024.

The FED Likely to Remain on Pause

The headline inflation rate moderated through June to 3.0%, but we have seen a modest re-acceleration over the last three months, prompting the FED to maintain its “higher-for-longer” posture with respect to rates. That being said, shelter and rent cost is the largest component of CPI, making up 43% of the index and had been the stickiest; however, over the last several months, we have seen a deceleration in real-time apartment rent indices. With continued downward pressure in rents and shelter inflation, combined with emerging employment weakness, the inflation rate should moderate after the October report CPI report (to be reported mid-November). These factors should give the FED additional ammunition to leave rates unchanged for the time being. While they may be reluctant to concede that the rate hiking cycle is over, Chairman Powell did make the following comment at the last FED meeting: “It’s fair to say…the question we’re asking <ourselves> is, ‘Should we hike more’?” As moderating rent prices push core inflation lower and the labor market cools, the FED should gain more comfort that the answer to the above question is “No.”

The Bottom Line

Following a strong start to the year in the stock market that led to a crescendo of optimism and “fear of missing out”, the market took a break and gave up some of those early gains. The broader market and small cap stocks, in particular, felt the pain of the past three month, given the 17% pullback in the small cap stock index. Keep in mind that the stock market tends to be a leading indicator of the direction of economic growth. Just as stock market action in 2022 foreshadowed decelerating economic growth into the back half of 2022, the stock market rally of 2023 seems to have also discounted the acceleration of economic growth in the 2nd and 3rd quarters of 2023.

One has to wonder what the last three months of market action may portend for the economy. We will be watching closely whether higher interest rates and the higher cost of capital across the economy begin to negatively impact the direction of economic growth. Looking at other key indicators of economic activity, this pace of growth is not likely to be maintained. Data coming from the manufacturing sector, along with decelerating labor growth and the prospects for a slowdown in consumer and government spending, could dampen growth over the next few quarters.

The interest rate backdrop has been challenging for intermediate and longer-term bonds, given the dramatic increase in interest rates over the last two years. While there remains some uncertainty with respect to the rate outlook, there is a strong probability that we are very close to a cyclical peak in rates, with peak inflation behind us. The housing market is seeing the impact of higher rates reflected in mortgage rates hitting 24-year highs. The collective impact of higher rates and higher capital costs are likely to manifest in future economic growth. We believe that the FED is seeing these early signals and is very likely to have completed the rate hiking cycle. Though, we expect the FED to remain vocal about maintaining higher rates until its inflation objectives are achieved.

At Bison, rather than trying to predict the market, we always build our client portfolios based upon our client’s goals and objectives, focused on the long-term and preparing for any market environment. While we currently maintain a cautious approach towards the equity and fixed-income markets, we do not shy away from those exposures. Rather, we seek to implement strategies within our client portfolios that can mitigate the typical volatility of the financial markets and maximize risk-adjusted returns over the long term. This approach has helped us to navigate changing market environments while still meeting the ultimate financial objectives of our clients.

Disclosures

Important Information

Investment Advisory services are provided through Bison Wealth, LLC located at 3550 Lenox Rd NE, Ste 2550 Atlanta, GA 30326 or Bison Advisors, LLC located at 140 Cateechee Trail, Hartwell, GA 30643. Securities offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA/SIPC. Bison Wealth, LLC and Metric Financial, LLC are not affiliate entities. More information about Bison Wealth or Bison Advisors and its fees can be found in their respective Form ADV Part 2, which is available upon request by calling 404-841-2224. Bison Wealth and Bison Advisors are independent investment advisers registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.

The statements contained herein are based upon the opinions of Bison Wealth, LLC (“Bison”) and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any model will be met. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bison or its affiliates to buy or sell any securities or investments or hire any specific manager. Bison prepared this Update utilizing information from a variety of sources that it believes to be reliable. It is important to remember that there are risks inherent in any investment and that there is no assurance that any investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of future results. All investments are subject to risk, including the loss of principal.

Index definitions: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index

Share this

- February 2026 (1)

- January 2026 (1)

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)