Share this

January 2024 Commentary

Feb 07, 2024

January 2024 Market roundup

Key Observations & Outlook

-

Mega-cap technology stocks continued the strong momentum from 2023, leading stock market returns for the month of January, while the broader market lagged.

-

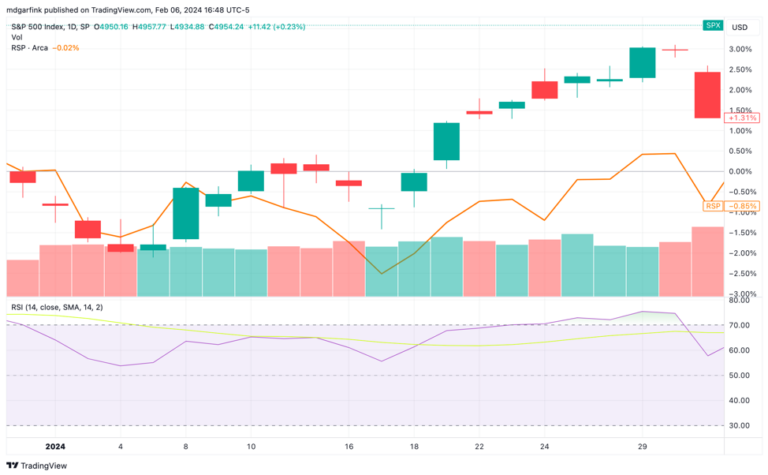

The S&P 500 Index rose 1.7% for the month, whereas the broader stock market as measured by the S&P 500 Equal-Weighted Index fell by 0.85%.

-

Small Caps and non-US stocks also started the year on a weaker note, with the S&P 600 Small Cap Index and the MSCI All Country Index down 3.95% and 0.99%, respectively.

-

S&P 500 stock valuations are pushing the against the upside of historic bands, trading at 20x forward earnings. However, this valuation level is a function of the high valuations of mega-caps.

-

Stock valuations of mid-size and smaller companies are much more reasonable when compared to historical levels.

-

Bonds had a modest pullback in January, as interest rates began creeping upward following the sharp downdraft we witnessed at the end of 2023.

Market Commentary

Mega-cap technology stocks picked up where they left off in 2023, propelling the S&P 500 to a positive gain for the month of January and new all-time highs for the benchmark. Dating back to late October, the index has recorded gains in 12 of the last 13 weeks, an occurrence that has not happened since 1985. Historically, this type of market movement has been indicative of future price gains in the year ahead. Despite relatively weak Q4 2023 earnings announcements thus far, with earnings down 1.4% and falling short of consensus estimates, the US equity market has surged ahead on encouraging inflation data, strong economic growth, and the continued expectation for rate cuts by the Federal Reserve in 2024.

Meanwhile, the broader market, as demonstrated by the performance of the equal-weighted S&P 500, as well as mid-cap and small-cap indices posted negative returns for January. A healthy market advance that is driven by solid economic fundamentals and corporate earnings growth should be more broad-based. It is our belief that this will happen at some point during the year if the economy is able to maintain positive economic growth. Current consensus forecasts for earnings growth of 11% for 2024 is a positive indication that the broad market could see stronger performance as the year progresses. Accelerating earnings growth across more companies would be required to attract capital away from the mega-cap growth stocks.

The Equal-Weighted S&P 500 trailed in January.

Market Sentiment and Stock Valuations

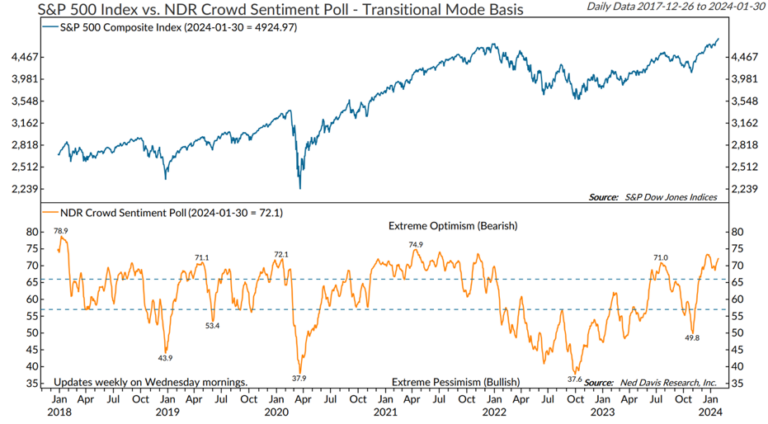

Given the market’s strong performance in 2023 and its recent 20% move off the October lows, one would think that the market may be due for a pullback, particularly when accompanied by excessive bullish sentiment and historically high valuations. Speaking to market sentiment, Ned Davis Research’s “Crowd Sentiment Poll” has been in the extreme optimism zone for 45 consecutive days, the 11th longest streak on record since 1995, indicating quite a high level of investor exuberance. Typically, at these times, the market may be more susceptible to a pullback with the slightest bit of negative news flow.

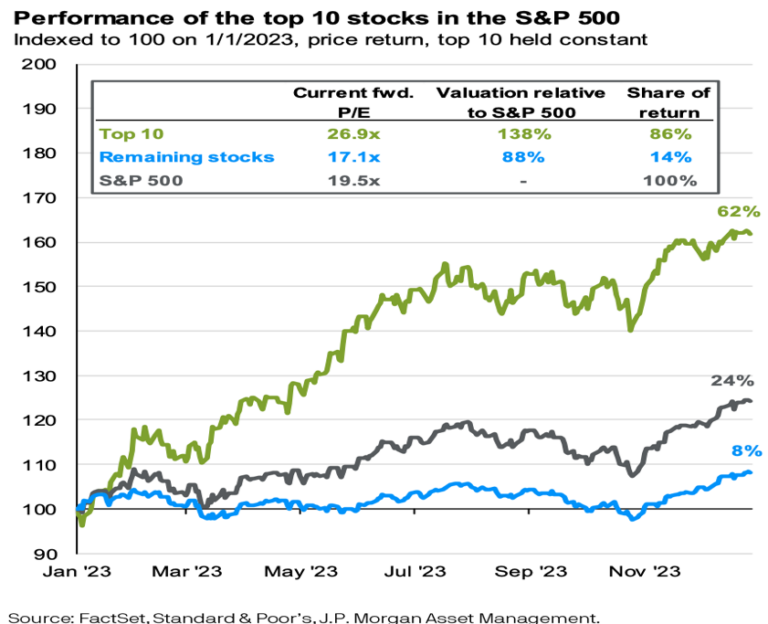

The S&P 500 is statistically expensive relative to the historical average Forward Consensus Price/Earnings (P/E) ratio, which as of January 26, 2024, sat at 20.0x compared to an average of 15.8x dating back to 1986. However, this reflection of valuation may be somewhat misleading. The chart below demonstrates not only how much the ten largest stocks in the S&P 500 contributed to the performance of the benchmark in 2023, but also that the forward P/E valuation of those same 10 stocks at 26.9x earnings is significantly above the average P/E of the other 490 stocks at only 17.1x forward earnings, right at the historic 30 year average for the S&P 500 Index.

Essentially, the market’s valuation may not be as high as it seems on the surface, setting the stage for potential multiple expansion for the broader market of companies and/or multiple contraction for the Mega Caps. That being said, with the forward P/E ratio of the market having expanded so quickly, from a low of 15.3x in October 2022 to 20.0x today, corporate earnings growth in 2024 will play a considerable role in determining if the market can continue to rise. Almost all of last year’s equity gains came from P/E expansion, as earnings were essentially flat for the year. History shows that we may have reached that part of the cycle where the baton must get passed from multiple expansion to earnings growth if we are to expect further equity gains in 2024.

Bonds Take a Breather

As we suspected, rates came down a bit too far and too fast in November and December, fueled by Fed comments that the rate hiking cycle was completed and that rate cuts should be expected in 2024. The Chairman of the Fed moderated those comments at the most recent Fed meeting, suggesting that rate cuts would be more dependent on the data we see from inflation, the labor market, and the economy. This led to a modest lift higher in interest rates and slightly negative bond returns for the aggregate bond benchmark, while short-term bonds managed to eke out a positive return.

The U.S. economy seems to have settled into a “Goldilocks” status, not too hot and not too cold. Recent data suggests that economic growth, while slowing from Q4, continued to expand in January with a rebound in travel, tourism, live events spending, and goods outlays. Further, there do not seem to be any signs of inflation re-acceleration at this juncture, but we still remain well above the Fed inflation target of 2%. The average prices of components, parts, and necessary inputs is down year over year, leading to a return of pricing power for manufacturing companies; but the recent decline in durable goods inventories along with a significant rise in shipping costs introduce the possibility that pricing pressures could re-emerge in the months ahead.

The Bottom Line

Following the recent Fed meeting, where Chairman Powell tempered market expectations for near-term rate cuts, the probability for cuts in the key short-term Fed Funds rate dropped to 20%, compared to a 70% probability just a month ago. We believe that it is important for the Fed to maintain control of inflation, and given the fact that the economy seems to be hanging in for now, there is no reason to lower rates which could increase the risk of rekindling inflation.

We maintain our posture that economic growth will slow from the rapid 4th quarter pace, but that the odds of settling into a recession continue to drop. As such, the focus for 2024 seems to be on the re-acceleration of corporate earnings growth in order to drive equity prices higher. Furthermore, this re-acceleration will be necessary to draw attention away from the mega-caps and shift the flow of investor capital into other companies. Investors tend to gravitate toward those companies that are demonstrating the strongest positive momentum of earnings growth.

The concentrated influence by a few stocks can be beneficial for equity markets in the short term, as it was in 2023, but the dominance of these stocks draws similarities with the dot-com bubble, raising the risk of a market sell-off, that could be led by these largest companies. Optimism about artificial intelligence has certainly played a key role in the advancement of these mega caps and may continue to do so, but maintaining a tactical and diversified approach to investing may prove beneficial since there will come a time when these stocks cannot sustain their recent trajectory.

Given the lower relative valuations of the broader equity market, including “value” stocks, small and mid-sized companies, and non-U.S. companies, we believe that portfolios can benefit from diversification away from these larger companies and into quality companies that demonstrate high levels of profitability, financial strength, and stable and/or growing dividends across the market cap spectrum. Lastly, we continue to construct portfolios with exposure to niche segments of the private lending market that can offer attractive income and returns with lower volatility and uncorrelated risks with traditional stocks and bonds.

Disclosures

Important Information

Investment Advisory services are provided through Bison Wealth, LLC located at 3550 Lenox Rd NE, Ste 2550 Atlanta, GA 30326 or Bison Advisors, LLC located at 140 Cateechee Trail, Hartwell, GA 30643. Securities offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA/SIPC. Bison Wealth, LLC and Metric Financial, LLC are not affiliate entities. More information about Bison Wealth or Bison Advisors and its fees can be found in their respective Form ADV Part 2, which is available upon request by calling 404-841-2224. Bison Wealth and Bison Advisors are independent investment advisers registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.

The statements contained herein are based upon the opinions of Bison Wealth, LLC (“Bison”) and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any model will be met. An investor should assess his/her own investment needs based on his/her own financial circumstances and investment objectives. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bison or its affiliates to buy or sell any securities or investments or hire any specific manager. Bison prepared this Update utilizing information from a variety of sources that it believes to be reliable. It is important to remember that there are risks inherent in any investment and that there is no assurance that any investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of future results. All investments are subject to risk, including the loss of principal.

Index definitions: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index

Share this

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)