Share this

December 2022 Commentary

Dec 06, 2022

DECEMBER 2022 Commentary

November brought about continued relief for stock and bond investors, as we approach the end of what has otherwise been a difficult year. For starters, let’s review the scorecard of the markets through the end of November and summarize our thoughts below.

- Continuing the strong rebound in stocks in October, the S&P 500 finished up 5.5% while small caps climbed 4%. From a sector perspective, the market was led higher by the Materials, Industrials and Financials sectors, as economically sensitive sectors rallied on hopes for a softer economic landing. Meanwhile Technology, Consumer Discretionary, and Energy sectors struggled reflecting continued concerns with consumer and technology spending.

- Foreign developed and emerging markets outpaced US markets by a wide margin with the MSCI All Country World ex US Index up nearly 11%.

- Bonds rebounded in November with the Aggregate Bond index up roughly 4.5%, as the realization of peak inflation and economic weakening seems to have taken over the investor mindset.

- The US Dollar, one of the best performing asset classes through September, has seen a pullback of roughly 7.5% from its highs. Interestingly, the US Dollar has traded at a near-perfect negative correlation to interest rates this year.

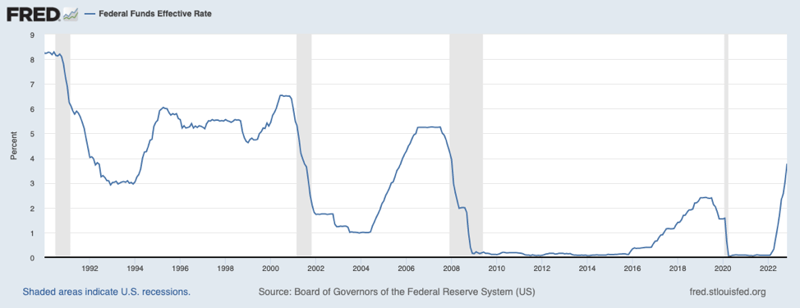

- The FED Chair reiterated the focus on taming inflation with no change to the target fed funds rate of 5% by early 2023. Stocks rallied on the fact that the FED is likely to increase the rate by only 50 basis points, compared to the latest increases of 75 basis points.

- We have likely reached peak inflation, but uncertainty remains around how fast inflation will subside.

- The market has rallied in the face of negative news for the US economy, as several key bellwether companies have signaled this weakness in their earnings forecasts. We would remain cautious toward equities as we head into 2023 with potential earnings risk ahead.

Transition from Focus on the FED to Economic Reality

For the last two or three months, investors have been welcoming bad news on the economy as good news for the stock market. Why is that? The market is inferring that weakness in the economy and slowing inflation will prompt the FED either to slow the pace of rate hikes, stop them altogether, or reverse course and begin easing again. With the current Fed Funds Rate at 3.78%, there was no change in the tone or content of FED Chair Powell’s recent comments with respect to the primary goal of bringing down inflation. It has been well-forecasted that the pace of rate hikes would slow with an ultimate target rate of 5.0%. Bottomline, no matter the pace, the FED is continuing to raise rates into the current economic slowdown.

The bond market has embraced this news of peak inflation with 10-year Treasury yields falling from a peak of 4.25% to the current level of around 3.50%. The stock market cheered the news as well with its rally over the last 7 or so weeks. So, for a quick recap, since the beginning of 2022, rates up has been bad for stocks and bonds, and rates down good for stocks and bonds. History would suggest that spikes in correlation between stocks and bonds are short-term, episodic phenomenon rather than enduring trends.

In the long-term, stock returns tend to revert to reflect the anticipated economic environment and future corporate earnings. To that end, a cautious picture is being painted as the current consensus economic outlook is that growth is slowing faster than expected and early earnings reports are indicating a potential corporate profit recession. The number of important bellwether companies that are already reflecting the economic weakness is increasing, including the likes of Amazon, Target, Apple, Google, Meta, Microsoft, Restoration Hardware and Salesforce.com. Given this backdrop, it is possible that that corporate earnings estimates may be overly optimistic for 2023 and will need to be revised downward, making it more difficult to apply an earnings-based valuation to the market.

From an economic data perspective, below are a few highlights of the economic data leading investors to soften their view on economic growth at home and abroad:

- US Manufacturing PMI for November was 47.7 vs. 50.40 in October (contractionary and new cycle lows).

- US Business Confidence for November was 49 vs. 50.20 in October (new cycle lows).

- ISM new orders for November 47.2 vs. 49.2 in October (Back to cycle lows).

- US Savings Rate is at 2.3% as of October, which is the lowest level since 2005.

- China Services PMI at 46.7 vs. 48.7 estimate, a new cycle low, and 2nd consecutive month of contraction.

- China exports were -14% YoY and negative for the 4th consecutive month.

- European PMI’s – 11 of 13 countries are showing sub-50 contractionary readings.

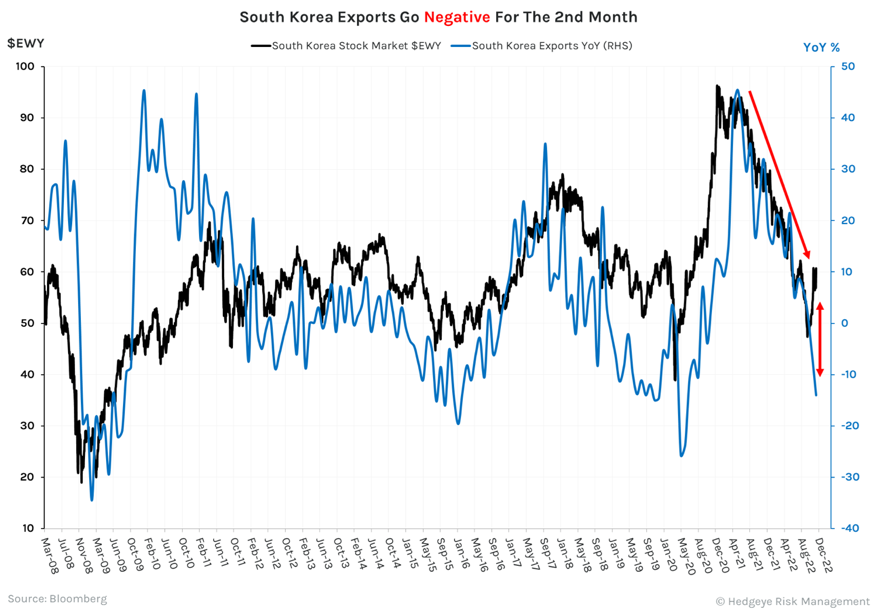

- South Korean exports came in at -14% YoY vs -6% from the prior month.

South Korea is an important barometer of global trade as 70% of the country’s economy is tied to export trade. The chart below shows the steep decline in South Korean exports, thus casting a shadow on the overall global economic outlook.

On a positive note, inflation seems to have peaked back in June and that is a step in the right direction, as it takes a little pressure off of the FED in terms of how aggressive they need to be to curtail inflation. But the jury is still out on just how fast inflation declines from here, particularly relative to expectations. Thus far, CPI Inflation is down to 7.7% from the 9.1% June peak and the PPI is down from 11.7% peak to 8% as of October. These numbers are still high and will force the FED to be vigilant with monetary policy. Furthermore, inflation will continue to apply pressure on company margins, as costs such as labor wages remain elevated, while slowing economic growth impairs companies’ ability to grow revenues.

In the long-term, we remain constructive on equity markets, and are increasingly comfortable with bond markets now that inflation has peaked and yields have risen to offer more compelling cash flows to investors. In the short-term, we would expect to see continued volatility in markets as investors weigh the pace of economic decline, how quickly inflation subsides in the coming months, and the impact of the above on corporate earnings as we head into 2023.

Disclosures

Important Information

Investment Advisory services are provided through Bison Wealth, LLC located at 1201 Peachtree St. Ste 1950 Atlanta, GA 30361. Securities are offered through Metric Financial, LLC. located at 725 Ponce de Leon Ave. NE Atlanta, GA 30306, member FINRA and SIPC. Bison Wealth is not affiliated with Metric Financial, LLC., More information about the firm and its fees can be found in its Form ADV Part 2, which is available upon request by calling 404-841-2224. Bison Wealth is an independent investment adviser registered under the Investment Advisers Act of 1940, as amended. Registration does not imply a certain level of skill or training.

The statements contained herein are based upon the opinions of Bison Wealth, LLC (Bison) and the data available at the time of publication and are subject to change at any time without notice. This communication does not constitute investment advice and is for informational purposes only, is not intended to meet the objectives or suitability requirements of any specific individual or account, and does not provide a guarantee that the investment objective of any model will be met. An investor should assess his/ her own investment needs based on his/her own financial circumstances and investment objectives. Neither the information nor any opinions expressed herein should be construed as a solicitation or a recommendation by Bison or its affiliates to buy or sell any securities or investments or hire any specific manager. Bison prepared this Update utilizing information from a variety of sources that it believes to be reliable. It is important to remember that there are risks inherent in any investment and that there is no assurance that any investment, asset class, style or index will provide positive performance over time. Diversification and strategic asset allocation do not guarantee a profit or protect against a loss in a declining markets. Past performance is not a guarantee of future results. All investments are subject to risk, including the loss of principal.

Index definitions: “U.S. Large Cap” represented by the S&P 500 Index. “U.S. Small Cap” represented by the S&P 600 Index. “International” represented by the MSCI Europe, Australasia, Far East (EAFE) Net Return Index. “Emerging” represented by the MSCI Emerging Markets Net Return Index. “U.S. Aggregate” represented by the Bloomberg U.S. Aggregate Bond Index. “Treasuries” represented by the Bloomberg U.S. Treasury Bond Index. “Short Term Bond” represented by the Bloomberg 1-5 year gov/credit Index. “U.S. High Yield” represented by the Bloomberg U.S. Corporate High Yield Index. “Real Estate” represented by the Dow Jones REIT Index. “Gold” represented by the LBMA Gold Price Index. “Bitcoin” represented by the Bitcoin Galaxy Index.

Share this

- February 2026 (1)

- January 2026 (1)

- December 2025 (3)

- September 2025 (1)

- August 2025 (1)

- July 2025 (1)

- June 2025 (1)

- May 2025 (1)

- April 2025 (1)

- March 2025 (2)

- January 2025 (5)

- August 2024 (8)

- July 2024 (1)

- June 2024 (1)

- May 2024 (1)

- April 2024 (1)

- March 2024 (1)

- February 2024 (2)

- January 2024 (3)

- December 2023 (1)

- November 2023 (1)

- October 2023 (1)

- September 2023 (1)

- August 2023 (1)

- July 2023 (1)

- June 2023 (1)

- May 2023 (1)

- April 2023 (1)

- March 2023 (1)

- February 2023 (1)

- January 2023 (1)

- December 2022 (1)

- November 2022 (1)

- October 2022 (1)

- September 2022 (1)

- August 2022 (1)

- July 2022 (1)

- May 2022 (3)